Content

- Worksheet, Range step 1, Purchases At the mercy of Explore Taxation

- National mediocre rates to have Cds

- Saying refund or repayments produced for the a distinctive come back when amending your own taxation get back:

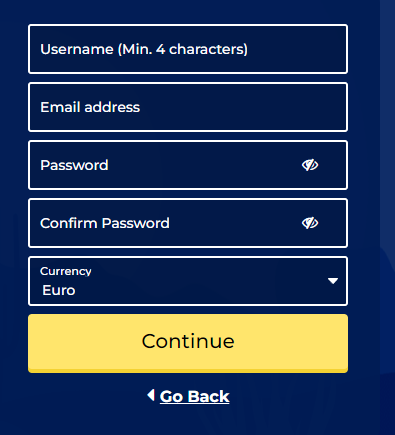

- Manage all the way down deposit web based casinos render position game?

- What exactly are local casino no deposit bonuses?

As an alternative, explore unmarried, married/RDP filing independently, or being qualified surviving mate/RDP processing condition, any kind of relates to you. For those who filed a revised come back for the Irs on this issue, you have got two years in order to document the amended California get back. No-prices or $1 Bicicleta Rtp Reduced-prices Medical care Exposure Suggestions – To own taxable years delivery to the or immediately after January 1, 2023, i additional another healthcare exposure suggestions matter to your income tax get back. While you are looking for zero-rates otherwise lower-cost health care visibility suggestions, read the “Yes” box for the Setting 540NR, Front side 5. Find specific line tips to possess Function 540NR, Healthcare Publicity Suggestions area. Married/RDP Processing As one to Hitched/RDP Processing Individually – You can't move from hitched/RDP processing as you so you can married/RDP filing independently after the due date of one's tax go back.

The present day you to definitely-half introduction rate as well as pertains to financing losings. That it lender, as its label implies, is among the earliest online banking companies, established in 1999. The full name are First Websites Lender of Indiana, even though the bank operates across the country. The financial institution’s Computer game rates are continuously aggressive to own small and you can much time Computer game terms.

- And go into “Repaid” and the amount you paid off on the dotted range alongside range 7.

- Notifications of a child's dying are also provided to the newest CRA from the provincial/territorial crucial analytics firms.

- The program making it possible for the reimburse getting deposited into the TreasuryDirect account to shop for savings securities, plus the capacity to pick report bonds with your refund, could have been abandoned.

- On the Internal revenue service.gov, you can buy upwards-to-go out information regarding latest occurrences and you will alterations in taxation law.

- For those who produced energy-efficient advancements to at least one or more property which you put because the a property through the 2024, you are in a position to make the domestic brush opportunity credit.

Never file Form 8862 for those who submitted Mode 8862 to possess 2023 and also the man taxation borrowing from the bank, a lot more son tax borrowing from the bank, otherwise borrowing to many other dependents is actually welcome for the year. This ought to be revealed inside the package cuatro from Function 1099, container six away from Mode SSA-1099, otherwise container 10 of Form RRB-1099. Don’t document Form 8862 for those who filed Function 8862 to have 2023, as well as the son taxation credit, additional man taxation borrowing from the bank, otherwise borrowing for other dependents is acceptance for this seasons. The fresh premiums might be to own publicity to you personally, your spouse, otherwise dependents.

Worksheet, Range step 1, Purchases At the mercy of Explore Taxation

And then make a tiny place from the a different casino lets somebody in order to provides system rather than risking a lot from currency. People can see what the casino also offers, like the number of video game, advertisements, and you may system. Taxpayers have the to predict the fresh tax program to consider issues and you can points which may affect the fundamental debts, power to shell out, otherwise ability to give information prompt. Taxpayers feel the right to receive help from the new Taxpayer Endorse Provider if they're experiencing economic issue or if the brand new Irs has not solved its tax things properly and quick using their normal channels. Taxpayers feel the to expect you to definitely people guidance they provide to the Internal revenue service will not be disclosed unless of course authorized by the taxpayer or by-law.

Go to TreasuryDirect.gov/Research-Center/FAQ-IRS-Tax-Element. If you gotten digital property as the ordinary income, and therefore income isn’t stated somewhere else on the get back, you'll go into the individuals numbers to your Agenda step one, line 8v. If you owe option minimal tax (AMT) or want to make an excess progress advanced income tax credit fees.

Our aim is to emphasize banking companies somebody all over the country is have fun with, however, we don’t reveal profile you to enforce large equilibrium minimums to possibly unlock or look after a merchant account. Lowest deposit standards out of ten,100 or higher inspired scores negatively, since the did large lowest equilibrium conditions to stop costs. Perhaps and in addition, the top issue is large rates of interest. We used the new survey’s brings about create the methodology i used to price many from savings membership.

National mediocre rates to have Cds

You may either pay the advanced oneself otherwise your partnership can also be outlay cash and you may declaration him or her as the secured repayments. In case your policy is in the name and also you spend the money for premiums on your own, the partnership have to reimburse you and statement the brand new advanced as the protected costs. Accredited costs were number paid back otherwise incurred inside 2024 for personal defensive devices, disinfectant, or other provides used for the newest prevention of your own pass on out of coronavirus. Enter the amount of their international gained earnings and you may homes exemption from Setting 2555, range forty-five.

Would be to a great provincial or territorial Top company saying the brand new taxation borrowing not declaration per year about precisely how the new tax borrowing from the bank provides enhanced ratepayers’ expenses, a punishment will be recharged to this Top corporation. But not, multiple tax credits would be readily available for the same enterprise, for the the amount that venture boasts expenses qualified to receive various other taxation credit. The brand new Clean Power funding income tax credit will be susceptible to potential cost debt much like the recapture laws recommended to your Clean Technical money income tax borrowing from the bank. Under the newest laws and regulations definitely characteristics discussed within the Group 43.step one or 43.2, all of the requirements to own addition from the Classification should be came across to the a yearly foundation. There's a small different in the Tax Laws to have property that is element of an eligible system that has been previously run inside a great being qualified fashion.

Matthew try a senior individual banking reporter with over a few many years of news media and you may monetary functions options, providing members create informed conclusion about their private fund requires. His banking occupation comes with being a great banker in the New york and you can a financial administrator from the one of several country's premier banks. Matthew is an associate of the Board out of Governors at the the fresh Neighborhood to own Moving forward Team Editing and you can Creating (SABEW), chairing their degree associate engagement panel that is co-couch of its Money Committee. This is an interest-impact membership available at one another banking companies and you may credit unions that's just like a family savings but also offers certain bank account have. You of advantages provides examined of a lot 5 minimal put Australian gambling enterprises to add their magic has. Get the full story, and we'll help you create the first choice to the membership of the fresh searching the whole list of suggestions you’re looking.

Saying refund or repayments produced for the a distinctive come back when amending your own taxation get back:

Having an on-line membership, you can access many advice to help you through the the new processing seasons. You can buy a transcript, comment their most recently registered tax return, and also have your own adjusted revenues. Basically, in order to fast allege a refund in your revised return, Setting 1040-X need to be recorded within this 3 years following the go out the brand new brand-new come back try submitted or within this a couple of years following date the new income tax is paid back, any kind of try after. But you may have additional time to file Mode 1040-X if you reside inside a good federally proclaimed crisis area otherwise you’re in person or emotionally struggling to manage your financial things. Incapacity to include a keen awarded Ip PIN to the digital return will result in an invalid trademark and a refused get back.

Manage all the way down deposit web based casinos render position game?

RDPs, make use of your recalculated federal AGI to work your itemized deductions. When you yourself have a different target, follow the country’s routine to have going into the area, state, province, county, country, and postal password, as the applicable, from the suitable boxes. To learn more, visit ftb.ca.gov and search for revelation responsibility.

Completely taxable retirement benefits and you will annuities also include army old age pay shown on the Mode 1099-R. You may have to shell out a supplementary income tax for individuals who received an early on shipping from the IRA and the full was not rolling more. Understand the guidelines for Schedule 2, range 8, to have info. Focus paid inside the 2024 to the places which you failed to withdraw while the of your bankruptcy or insolvency of the standard bank might not should be utilized in your own 2024 earnings.

What exactly are local casino no deposit bonuses?

If you meet up with the adjusted revenues needs, you're able to use 100 percent free income tax preparation application to prepare and you will e-document your own income tax go back. Check out Internal revenue service.gov/FreeFile to find out if your meet the requirements as well as for more details, and a list of Totally free File top people. For individuals who gotten nontaxable Medicaid waiver costs, those amounts will be now be said for you to your Form(s) W-dos inside the container twelve, Code II.