Articles

As the remainder of Wall structure Highway are form large forecasts to possess bullion, the guy thinks you to gold—and therefore reached a checklist-higher this week—you'll ultimately tumble to $1,820 an oz across the second 5 years. So, if you are looking to central bank to purchase since the an indication of your power of your own industry, you could believe that the is proof one we have been most likely handling the conclusion that it ten-year bull business inside the gold. As i nonetheless believe there is specific strength leftover in this market across the coming year or more, the time has come as sleep which have you to eyes open on the get off doorway would be to it greatest be struck also before than We assume. In addition Man's Financial out of Asia buying the most silver amongst the world's central banking institutions, the world as well as recorded the highest quantity of retail silver sales. Macquarie also offers forecast silver prices so you can notch the brand new levels inside the the following half of the entire year. While you are accepting you to real purchases out of silver provides given prices a great lift, Macquarie's strategists attributed the brand new previous $one hundred spike inside the rates to help you “tall futures to find” inside their notice dated February 7.

To your upside, resistance in the $dos,900 you'll limitation development, with increased traps at the $step three,000-$3,020 and you may $step three,130 if the Silver effort a new checklist higher. The fresh Republican-managed United states Home of Representatives to your Thursday narrowly introduced President Donald Trump's sweeping income tax and you may using statement. Trump's called “Big, Breathtaking Statement”, that may add in the $step 3.8 trillion go now to your government government's financial obligation over the 2nd 10 years, today brains to the Senate to own recognition. In the past sixteen years goldRush Rally has not only founded alone as the top-quality automotive lifetime Rally, but as the a worldwide social feel on the common visitors they attracts. No detail left untouched, goldRush Rally demands you to see a much better a style of honoring the brand new motor vehicle dream than simply with our team. Robert ArmstrongWell, you are aware, Katie, tomorrow on the Wednesday, we do have the most crucial earnings report international.

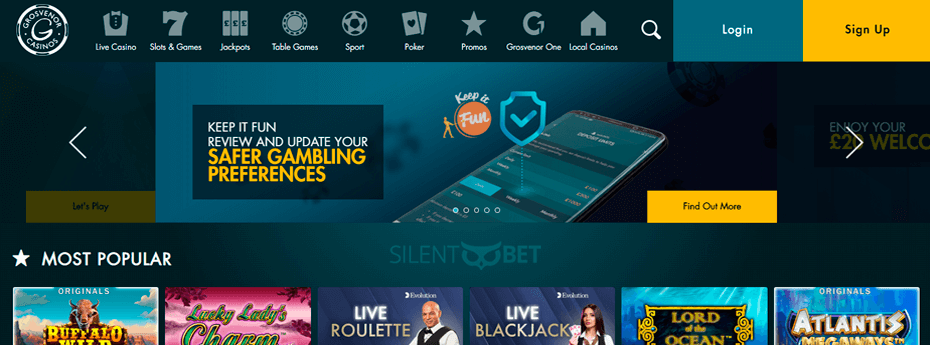

The odds from effective are the same no matter what and that system your use, while the are the earnings. Near-identity energy get ebb and circulate, but traditional to possess proceeded market volatility – motivated from the issues for example coming trading plan and you may rising cost of living – ought to provide a number of service to help you flows over the average-to-long term. James Hyerczyk is actually a good You.S. centered knowledgeable technology analyst and you may teacher with over forty years out of experience with market investigation and you may change, devoted to chart designs and you can price direction. He or she is mcdougal out of a few courses to your technology analysis and have a back ground in futures and you may inventory segments. Considering the fact that moreover it features typical volatility, this can be a-game that may provide large winnings for those who plan to wager a real income. The aforementioned on-line casino recommendation is actually our primary testimonial out of where to experience Silver Rally.

- Unlike deterring Russia, it move had the unintended results of moving the country to help you stockpile silver so you can circumvent the brand new dollar’s weaponization.

- Over the past two years, China have brought in up to 700 metric tons of silver on the United kingdom, tripling gold's share within the international reserves to 8%.

- Full, our very own strategists predict a complete get back of five% on the GSCI Product List in the 2025, off in the 12% total send it back needs for this seasons.

Really does the cost of gold increase if the stock exchange goes down?

Particular trust the fresh silver field’s rally is an expression out of buyers powering just before themselves to your wagers for the rate cuts. “It’s maybe not a formality that Fed is going to slashed costs,” said Carsten Menke, head out of second age bracket search from the Julius Baer. The newest nominal highest has come even after outflows away from silver-recognized change traded finance away from 21mn ounces previously season, based on Bloomberg.

Main banking institutions did multiple orders inside 2022 and you may 2023 but i have since the went straight back, revealing only 136 tonnes of net purchases since the March. The fresh Chinese central lender has purchased no gold for five months (officially). Even if its money is always to increase pretty much in line having higher gold prices, its express costs provides lagged about the newest material itself over the previous 36 months. Investor need for silver-recognized exchange-traded fund (ETFs) is at the fresh heights, that have holdings during the the high profile as the Sep 2023. Which rise shows a wider change to the secure-refuge property in the midst of business volatility and you may means a serious way to obtain interest in gold.

Gold Surges for the China's Monetary Analysis Release

However, central banks are beginning to believe perhaps from the margin it would be best if you involve some non-dollar property. Robert ArmstrongI imagine there is certainly a great constituency within the locations that really distrusts authorities generally speaking and you may main banks specifically. Therefore the government is reckless in this it borrows this money and you can props within the discount in the wrong minutes and you can the like and the main lender is actually irresponsible in that they prints all of this money. And there are somebody, I mean, correctly therefore, who want to be in a secured item that's protected from the individuals real or sensed changes.

John Reade, head business strategist in the WGC, states it seems your causes people are to buy gold “aren’t indeed really regarding the united states and you can west economic areas”. Today’s gold marketplace is itself an excellent herald for the menacing sickness. Gold could have been ascending within the lockstep using its arch-nemesis – the united states dollar – getting together with a just about all-time high of $dos,790 a week ago. Reuters claimed the other day that Financial away from The united kingdomt, which places silver to possess main banking companies, are sense withdrawal delays as much as monthly – much longer than common month. When you're $step three,000 would be a significant mental height, of a lot experts comprehend the metal moving higher still. In the February, Goldman Sachs and UBS elevated the predicts to own 2025 to $step three,100 and you may $3,2 hundred, respectively, when you are Bank away from America’s Michael Widmer says silver you may hit $step three,500 an oz if investment request expands because of the ten%.

If the have is fairly fixed, then changes in rates are all about consult. At all, early in 2024, silver properly broke out from the mug-and-manage development that had shaped as the 2011. With a gold price of simply over USD dos,600 after Sep, the brand new gold rates is at the entire year-stop forecast of our Incrementum Gold Price Anticipate Design to possess 2024. We demonstrated so it model the very first time on the In the Gold We Believe Report 2020 and now have since the updated it in almost any subsequent In the Gold I Believe declaration. But the measurements of the newest moves inside the Treasury efficiency as well as the buck don't apparently wholly justify the new rally inside gold, state analysts.

While you are Silver Rally was developed long ago inside the 2004, it's gone lower than some adaptation developments recently. Among the updates they gotten is actually a mobile-friendly variation, very United kingdom professionals is make an effort to winnings the newest modern jackpot of anywhere. The newest gameplay, possibility, winnings, and playing choices are a similar to the mobile as they are to your a desktop computer.

Try geopolitical tensions impacting silver prices as well?

Silver is often thought of as an enthusiastic inflation hedge, but their larger obtain features coincided that have an excellent deceleration away from speed develops. Such projections are based on continued geopolitical suspicion, after that central bank sales, and a great accommodative monetary policy ecosystem. In the middle of extreme conjecture, the new Government Set-aside reduce rates of interest the very first time as the the termination of July 2019, and ultimately by the a surprising 0.fifty fee issues. Whatsoever, the very last times the newest Government Set aside cut rates by 0.fifty commission points was in the January 2001 and you will September 2007 in the course of financial disorder. The newest stage out of losing interest levels one began with this bombshell will be able to enhance the gold speed.

While the a yield-shorter investment, Gold has a tendency to increase which have down rates, while you are higher borrowing from the bank will cost you always consider to the red-colored steel. However, really moves confidence how You Dollar (USD) acts because the asset try charged inside bucks. A powerful Dollar tends to hold the price of Silver managed, while a weaker Dollars tends to push Silver costs up. Steven Jermy, a renewable time government who served in britain’s Royal Navy to own 34 many years, believes — and you can holds a lot of his money within the gold and silver coins. The guy estimates your gold price have on the 30 % additional upside as the the guy believes the united states would need to increase their way to avoid it of the personal debt situation.

Up to Will get, people’s Bank of Asia had ordered gold to have 18 successive months. The fresh surge in expense have stemmed mostly from immense appetite to own gold one of main banking companies lately, particularly from the main lender inside Asia, advantages told you. Very every once inside a while miners kind of rating religion and type of think, let's say we return rather than much more holes? Similar to this taken place on the shale globe in america, in which shale workers as opposed to drilling openings within the arbitrary towns in the the us made a decision to simply pull oil regarding the the the fresh holes they had and provide the bucks on the traders.

Play Gold Rally Video slot

Another a lot more possible cause for the insufficient bullion within the London can be found looking at central banking companies, specifically those of emerging regions, who have been increasing their acquisition of silver. Highest silver costs features recommended manufacturers to keep exploration much more gold, but higher also provide can also add down pressure to the rates regarding the future years, Mills told you. Gold has been a shock champion of one's Trump change because the traders find defense in the midst of the policy a mess, but you will find expanded-term style you to jeopardize to help you drag the fresh metal back down in order to earth. Worldwide myself recognized gold ETFs saw its fifth consecutive month-to-month inflow within the September, attracting Us$1.4bn. Inflows were focused inside the North america inside week when you're European countries is actually the sole area one to experienced outflows, albeit simply reasonably. Carried on inflows lately trimmed y-t-d outflows out of international gold ETFs’ in order to flip self-confident to help you $389mn.